(Lecture given by Shri S.P.Mishra in National Seminar on Rural Empowerment through Broadband organized by Institution of Electronics and Telecommunication Engineers in Lucknow )

At the outset I would

like to thank the organizers for inviting me in the seminar for presenting a

paper. I have selected the topic from the Banking domain “Financial Inclusion” the

success of which is predominantly dependent on ICT. I am of the view that

financial inclusion is directly proportional to digital inclusion.

FINANCIAL INCLUSION

Financial inclusion is

the delivery of financial services at affordable costs to sections of disadvantage

and low income group of the society.

WHY FINANCIAL INCLUSION?

Unrestrained access to public goods and services is the sine

qua non of an open and efficient society. As Banking Services are in the nature

of public goods and essential need of life; the availability of banking and

payment services to the entire population without discrimination is the prime

objective of this public policy.

- This will help in bringing last person of the society in the

main stream of the nation.

- Maintaining a 9%

(approx.) GDP growth rate on a consistent basis requires the assimilation of a

large section of the unbanked and under banked population into the formal

financial system.

- Tap into hitherto

inaccessible savings, enable asset creation and enhance productive efficiency

through credit provision.

-

Financial Inclusion

is a pre requisite for "inclusive growth" - a key governmental agenda.

WHY FINANCIAL EXCLUSION HAPPENED?

Inadequacy of branch

network more especially in rural areas deprived a large chunk of population

from banking coverage. As of now branch network of all the Banks in India as on

31.03.2012 is as under (Source RBI)

All Commercial Banks

|

173

|

Of which ASCBs *

|

169

|

*Includes RRBs

|

82

|

Non Scheduled Banks

|

4

|

Branch Network: (As on 31.03.2012)

It may be observed that for 70% population in rural areas, share

of branches is 37% only. Only about 5% of 6 lakh villages in the country have

bank branch and there are 296 under banked districts in the country.

WHO ARE EXCLUDED?

-

Marginal Farmers

- Landless Farmers / Laborers

- Oral Lessees

- Self Employed

- Urban slum developers

- Migrants

- Social excluded groups

- Senior citizens

- Women

- And almost all poor villagers

CONSEQUENCES

OF FINANCIAL EXCLUSION

Consequences may vary depending on the nature and

extent of services denied. It may lead to increased travel requirements, higher

incidence of crime, general decline in investment, difficulties in gaining

access to credit or getting credit from informal sources at exorbitant rates,

and increased unemployment, etc. The

small business may suffer due to loss of access to middle class and

higher-income consumers, higher cash handling costs, delays in remittances of

money. I personally feel that financial exclusion can also lead to social

exclusion.

FINANCIAL

INCLUSION STEPS TAKEN AFTER INDEPENDENCE

- Co-operative Movement

- Setting up of State Bank of India

- Nationalization of banks

- Lead Bank Scheme

- RRBs

- Service Area Approach

- Self Help Groups

BUT

STILL WE FAILED ! WHY ?

-

Absence of Technology

- Absence of reach and coverage

- Delivery Mechanism

- Not having a Business model

WHAT NEED TO BE DONE?

More and more branches

are required to be opened in Rural areas. But this is uneconomical and

non-viable preposition owing to high cost of operation of the bank vis a vis low

revenue generation. This necessitated to prepare such models by which banking

facilities can be provided at unbanked areas at affordable cost with minimal

investment.

Since

almost all the PSU banks who are the main stake holders of financial inclusion

project are on CBS, which ever model is adopted the connectivity and technology

remains the challenge.

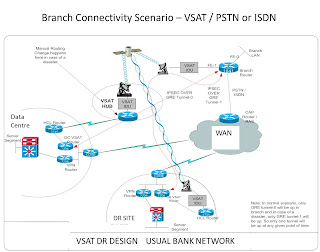

There are basically 3

models to address the financial inclusion.

- Branch Model

As

per RBI directives, banks are required to open normal brick and mortar branches

in the villages with population more than 5000 in unbanked district and 10000

in other districts. In rural areas in deep interiors still lease lines are not

available and therefore VSAT is the only option for the banks to open branches till

any cost effective robust alternate system is developed. The operational cost

of such branches is high as compared to revenue in the beginning and therefore

branch expansion is a problem.

2. USB Model

Where normal branch is not viable, Bank can open Ultra Small Branches (USB). These branches are normal branches as for as infrastructure is concerned but owing to certain restrictions on type and volume of transactions and also some deviations in relaxed working days these are treated as cost effective from man power angle.

3. Business Correspondent Model

RBI

has permitted appointment of Business Facilitator (BF) and Business

correspondent. While BF travels in the area and mobilise business i.e.

application for opening of accounts, Kissan Credit Cards, Deposits etc., the BC

provides the basic banking services to the local people. These BC may be an

individual or an entity like NGO, Corporate, Firm, NBFC etc. Naturally there

are two different types of system and technology.

- Corporate BC :

These

BCs have tie ups with the banks for service and settlement. They appoint sub BC

or create customer service point (CSP) on their behalf. They are responsible

for sub BCs or CSPs and claim compensation/ remuneration from the bank and

share with sub BCs and CSPs. This model is normally based on use of mobile

phone and hence is very cost effective. But still there are villages where

connectivity of mobiles is also not available.

Mobile

based models are of two types ~ Card based and Card less

- Card based

:

Under

this model a mobile specially designed for the purpose is used which has a

camera and GPRS facility. Other equipment is a portable small printer for

printing receipts and a biometric device connected with mobile phone through Bluetooth.

The application for the account opening form is filled and thumb impression of

the customer is affixed on it. The CSP capture photo of the form and send it to

server of the BC through GPRS. Finally after checking, data is sent to link branch

for validation where hard copy is sent by the CSP. After validation the data is

sent for issuing Cards. The customer approaches CSP as per his convenience for

transactions. The data on card is read by the mobile and then customer through

biometric device authenticates the transaction. A printed receipt is generated

and given to the customer.

- Card less

- The model is cost effective as it avoids cost of Point of Sale device (PoS) and smart card

- Avoid cost of PC-kiosk infrastructure and finger print capturing device.

- Real-time transactions with instant update and supported by USSD based Messages initiated by customer/ CSP using mobile,

- Three level security i.e. customer’s mobile number, one time usable PIN book and PIN created by the customer himself, provide sufficient security in the channel.

-

The customer

may transact at any CSP without any location limitation. a) Customer

Interaction - these CSPs interact and facilitate the customers for their

respective banking transactions.

- Individual BC:

In this model individuals tie up with

the banks, which require some mechanism at Bank level for connectivity and

settlement besides ensuring safety and security of transactions. SBI has

developed a very robust system for individual BCs which provide URL based

access to the server created for the purpose BC requires ID, PW and biometric

authentication. Customers too require biometric authentication for all type of

transactions. The BC has intra-day limit of cash transactions in addition to

cap on individual cash transactions.

What

are the Key Success Factors in "Financial Inclusion"?

- Low per transaction cost

through use of Branchless banking model

- Enabling the right ICT

(Information & Communication Technology) solution to provide the last

mile connectivity

- Leverage economies of scale

- Offer all the 4 Pillars of

Financial Inclusion : Savings, Credit, Remittance and Micro Insurance,

Micro SIP and Micro Pensions

NATIONAL COMMITMENT

Moving towards

universal financial inclusion has been both a national commitment as well as a

public policy priority for our country. To achieve the ultimate objective of

reaching banking services to all the 600,000 villages, financial inclusion has

to become a viable business proposition for the Banks. For this to happen, the

delivery model needs to be devised carefully so as to move from a cost-centric

model to a revenue-generation model. This will help in providing customers with

quality banking services at their doorstep and at the same time generating

business opportunities for the banks. This is sustainable only if delivery of

banking services, at the minimum, includes the following four products:

• A savings-cum-overdraft account

• A remittance product for electronic benefits transfer (EBT)

and other remittances

• A pure savings product, ideally a recurring deposit scheme

• Entrepreneurial

credit in the form of a Kissan credit card (KCC) or a general credit card (GCC)

Digital

Inclusion and Financial Inclusion should go side by side

Broadband is electricity

for the 21st century. If the bandwidth is given to grassroots innovators, they

are ready to implement millions of ideas. While rural India has fairly good coverage of mobile

telephony mainly for voice communication, internet/broadband services are yet

to make an impact. If 3G /4G may be the game

changer if these are made cost effective in as much as large population in

rural and semi urban areas has appetite for accessing internet and some of them

are making access through public kiosks / shared system. The rural India,

however, still waits for intensive internet penetration on affordable cost.

With this back drop Information and communication technologies (ICTs) is yet to

play role of facilitators of socio-economic development in rural India which

lacks basic infrastructure in health education and financial services.

CONCLUSION

The speedy growth of mobile telephony has brought

improved connectivity and this, in turn, has contributed significantly to the

socio-economic mainstreaming of rural India. However, intensive penetration of

internet through speedy broadband is necessity for digital and financial inclusion

at affordable cost, which only will ensure overall development. Contrary to misconception

of most people rural india has huge

untapped potential. Financial inclusion and Digital

inclusion are the same in the way as both involves two elements, one access and

other awareness. The latter is very

important. It is a global issue, and the relative emphasis on the two elements

varies from country to country. For developed countries with widespread

infrastructure, the access to financial products/services is not a matter of

concern. It is more of a financial literacy issue. In developing countries like

India, infrastructure is a big hindrance.The demographic profile of the country indicates that

more than 50 per cent rural Indians are less than 25 years old with growing

literacy rate, the demand for broadband and technology based products will keep

on accelerating.

I am sure increased telecom

connectivity will translate into overall rural development including financial

inclusion but digital inclusion is the

key for rural empowerment.

####

####

***************************

इसका हिन्दी रूपान्तरण हम हिन्दुस्तानी पर उपलब्ध है

***************************

No comments:

Post a Comment